What Is Cash Flow

and Why Is It

Essential in Hospitality?

The hospitality industry is highly dynamic and competitive. Offering quality food, beverages, and services is crucial, but equally important is maintaining a clear understanding of your finances. Effective cash flow planning is a key component in ensuring financial stability.

What Is Cash Flow?

Cash flow refers to tracking the amount of money entering and leaving your business, whether through bank accounts or cash transactions. Managing numerous invoices and payments each month can be overwhelming. Proper cash flow planning helps organize finances, providing clarity and ensuring sufficient funds are available for all transactions. Poor cash flow management is a common reason businesses fail.

Why Is Proper Cash Flow Management Important?

Here are several reasons:

- Smooth Operations: Proper planning ensures uninterrupted daily operations.

- Current Balance Awareness: A clear financial overview helps determine available funds and pending obligations.

- Business Expansion Planning: Understanding cash flow aids in budgeting for new ventures or locations.

- Expense Tracking: Monitoring cash flow reveals spending patterns on ingredients, wages, and other costs.

- Investment Decisions: Knowing your financial position informs decisions on equipment upgrades, furnishings, or marketing efforts.

Common Cash Flow Issues

A primary issue is losing track of payment schedules, leading to missed or late payments. Unexpected bulk payments can strain accounts, causing financial distress. Exceeding credit limits with suppliers may result in immediate payment demands upon delivery, disrupting operations.

Similarly, you might find yourself in a situation where you exceed a certain debt limit with your supplier, they deliver the goods to you, and along with the invoice, the driver demands cash payment on the spot. So, in essence, you won’t receive the goods for sale until you pay everything immediately. That’s definitely something you want to avoid.

Similarly, you might find yourself in a situation where you exceed a certain debt limit with your supplier, they deliver the goods to you, and along with the invoice, the driver demands cash payment on the spot. So, in essence, you won’t receive the goods for sale until you pay everything immediately. That’s definitely something you want to avoid.

Calculating Cash Flow

In practice, it’s actually simple – add up your income and subtract your expenses. Also, remember that a cost is not the same as an expense. Generally speaking – a cost arises on the day the invoice is issued, while an expense occurs on the day you pay it.

And while we’re clarifying terms: do you know the difference between a profit and loss statement and cash flow?

And while we’re clarifying terms: do you know the difference between a profit and loss statement and cash flow?

These are actually two different ways of looking at money in a business.

● Profit and Loss Statement: Shows the profitability of the business over a certain period.

● Cash Flow: Shows how money moves within the business over time and how the company handles it. It is analyzed over different periods, most commonly monthly or quarterly.

It definitely pays off to monitor both, because the profit and loss statement and cash flow provide different insights into how the business manages its finances.

Excel spreadsheets are often used for calculating and planning cash flow. But keep in mind that this approach isn’t exactly ideal. Even if you find a cash flow template, collecting invoices and receipts, manually entering expenses and income, sorting them by supplier, due date, and categorizing by expense type can easily take 20 to 40 hours per month. And as we all know – time is money.

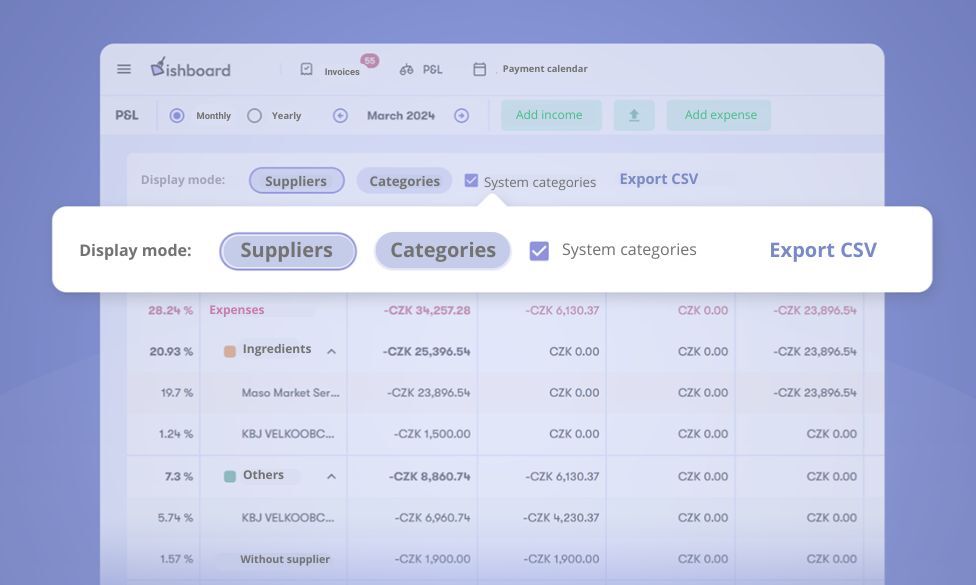

If you want to take your cash flow planning into the 21st century and get an automatically generated, management-level financial report, try the Dishboard app. Thanks to artificial intelligence, integrations, and a clear design, you’ll immediately see whether your business is profitable, how many invoices you need to pay this week, and whether you have enough funds to cover them. So it’s no surprise that over 150 satisfied customers – including top establishments you definitely know – have embraced it in the past year.

So, are you ready for simpler and more profitable business in hospitality?

Try Dishboard!

● Profit and Loss Statement: Shows the profitability of the business over a certain period.

● Cash Flow: Shows how money moves within the business over time and how the company handles it. It is analyzed over different periods, most commonly monthly or quarterly.

It definitely pays off to monitor both, because the profit and loss statement and cash flow provide different insights into how the business manages its finances.

Excel spreadsheets are often used for calculating and planning cash flow. But keep in mind that this approach isn’t exactly ideal. Even if you find a cash flow template, collecting invoices and receipts, manually entering expenses and income, sorting them by supplier, due date, and categorizing by expense type can easily take 20 to 40 hours per month. And as we all know – time is money.

If you want to take your cash flow planning into the 21st century and get an automatically generated, management-level financial report, try the Dishboard app. Thanks to artificial intelligence, integrations, and a clear design, you’ll immediately see whether your business is profitable, how many invoices you need to pay this week, and whether you have enough funds to cover them. So it’s no surprise that over 150 satisfied customers – including top establishments you definitely know – have embraced it in the past year.

So, are you ready for simpler and more profitable business in hospitality?

Try Dishboard!

Cookie settings

Cookies necessary for the website to function properly are always allowed. Other cookies can be configured.